Table of Contents

Capital One Bank Settlement 2024 How much will I get A lot of people are interested in the Capital One Bank Settlement 2024 and wonder, “How much will I get? You’re in the right place if you’re wondering how much you could get and what this settlement means for you. This post will walk you through comprehending the settlement details and help you discover your potential payout. Learn all there is to know about the Capital One Bank Settlement 2024, whether you are directly involved or just interested.

What Is the Capital One Bank Settlement 2024 how much will I get?

In 2024, Capital One Bank reached a significant settlement to address issues impacting many customers. This agreement aims to compensate affected individuals for challenges or damages they experienced. Capital One Bank has committed to offering a financial resolution, which includes a payout for eligible customers. But how much can you expect to receive? Let’s look deeper to find out.

Why Was the Capital One Bank Settlement 2024 Necessary?

The Capital One Bank Settlement 2024 resulted from issues involving customer data, bank operations, or fees that impacted many people. By compensating people impacted for their losses, this settlement aims to put things right. Customers may be eligible for reimbursement in 2024 if they comprehend why this settlement was required.

Background of the Capital One Bank Settlement 2024 how much will I get?

Capital One, one of the largest banks in the U.S., recently faced legal actions stemming from two significant issues:

Data Breach Settlement

In 2019, a significant data breach at Capital One exposed the personal information of around 98 million customers and credit card applicants. This incident sparked a class-action lawsuit, leading to a $190 million settlement agreement in 2021.

Representment Fees Lawsuit

Another lawsuit focused on Capital One’s practice of applying representing fees to transactions that initially failed due to insufficient funds but later went through once funds were available. This legal case concluded with a $16 million settlement in 2024.

Am I Eligible for the Capital One Bank Settlement 2024?

Eligibility is crucial to determining “how much will I get.” To be eligible for this settlement, you’ll need to meet specific criteria set by Capital One. Here is a summary to determine your eligibility:

Eligibility Criteria

| Eligibility Category | Criteria |

|---|---|

| Data Breach Settlement Eligibility | Residents of the United States whose private data was compromised in the 2019 hack |

| Individuals who received a notification indicating possible eligibility | |

| Those who submitted a valid claim by the deadline of November 27, 2023 | |

| Representment Fees Settlement Eligibility | Capital One account holders who were charged re-presentment fees from January 12, 2022, to September 1, 2015 |

| Eligibility applies to both current and former account holders |

You can submit a claim to get your payout if you meet the criteria.

What is the anticipated amount of my settlement?

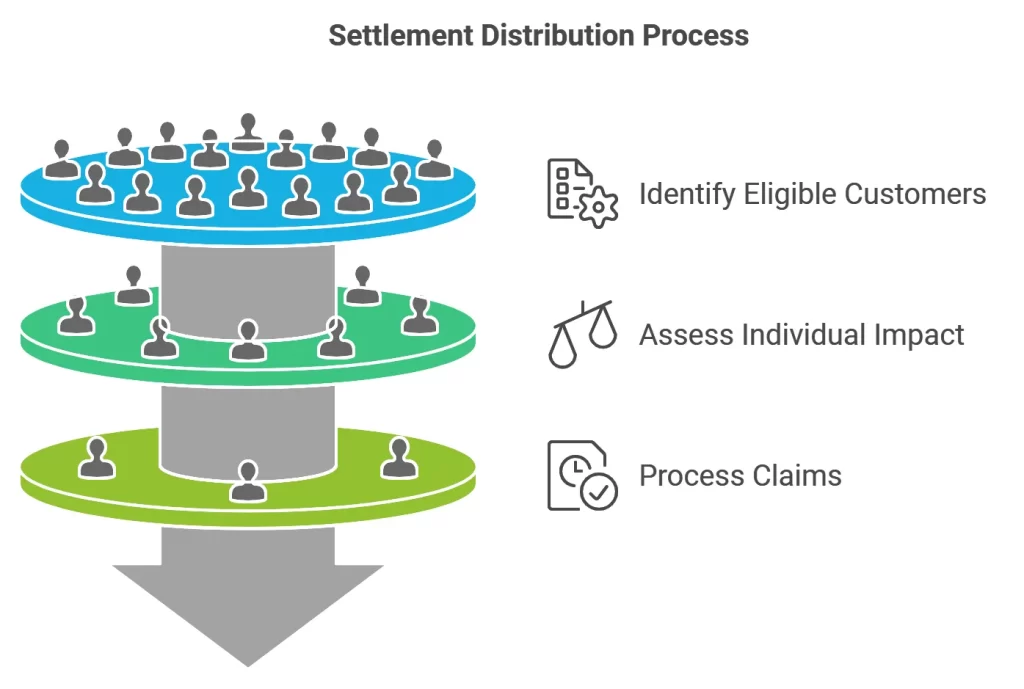

The question Capital One Bank Settlement 2024—how much will I get? is among the most frequently asked. Each person’s experience determines the reward amount. Here’s what affects your potential payout:

- Number of Eligible Customers: All eligible participants split the total amount available.

- Individual Impact: The payout may consider the level of impact each person experienced. Those with more severe issues might receive higher compensation.

- Claim Submission Timing: If you file a claim early, it’s more likely to be processed in time.

Although exact numbers are not provided, most settlements provide estimates based on similar cases, so you may soon get a general idea.

Also Read: What’s Your Share? Capital One Bank Settlement 2024—How Much Will I Get?

How to Submit a Capital One Bank Settlement 2024 Claim

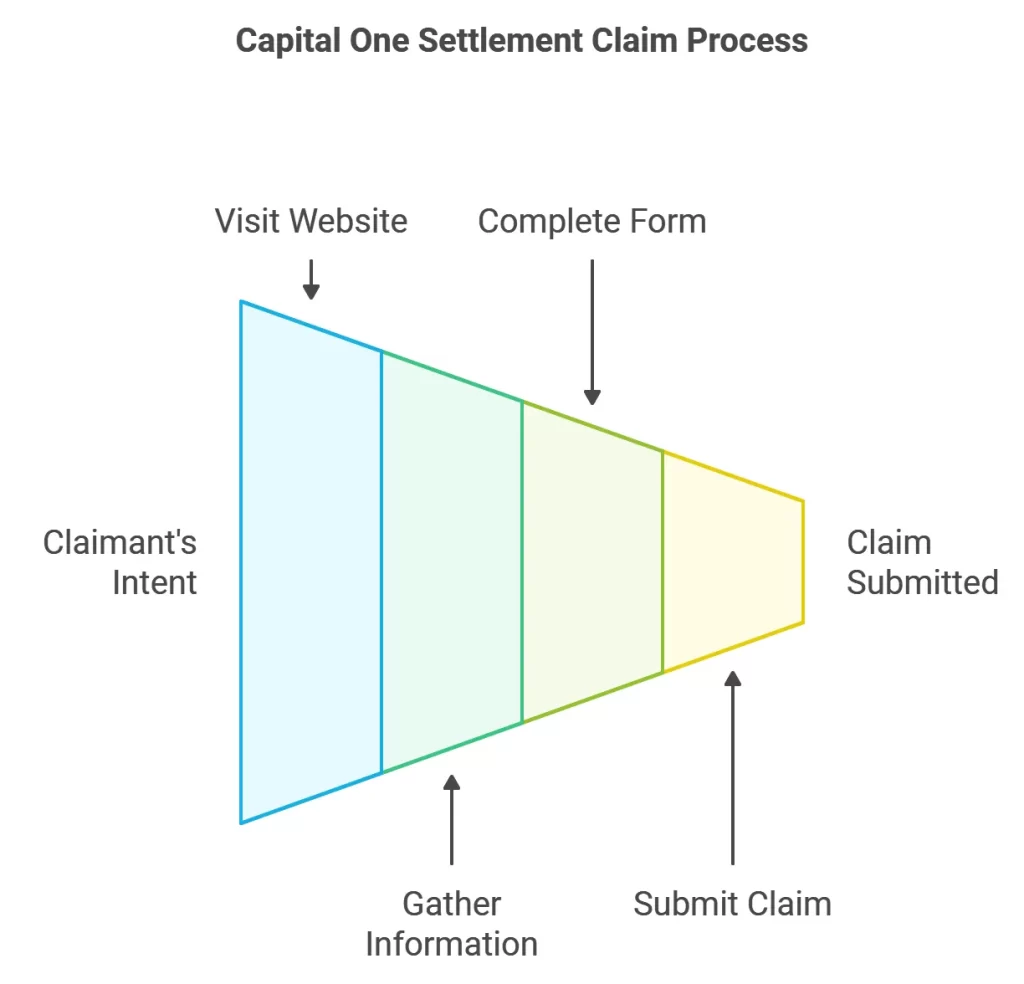

If you’re eligible, the next step is to submit a claim. Making a claim is the only way to ensure you receive your share. Here’s a simple guide to help you get started:

- Visit the Official Settlement Website: The official settlement website is the safest place to file.

- Gather Required Information: Prepare details like your Capital One account info or any related documentation.

- Complete the Claim Form: The form will ask questions about your Capital One experience and contact info.

- Submit Your Claim: Once completed, submit the form and save a copy for your records.

The process is straightforward, so don’t miss the opportunity to get your share of the settlement.

Also Read: Integration Techniques Unleashed: Transform Your Workflow Today!

What Happens After I File My Claim?

Once you file, the settlement administrators review your claim. Here’s what to expect:

- Claim Processing: The team will verify your eligibility based on your provided information.

- Payout Distribution: After processing, you’ll receive your payout based on the settlement terms.

- Notification: You’ll be notified via email or mail regarding the status of your claim and payout timeline.

Keep an eye on any notifications to stay updated.

Also Read: Authoritative Leadership Style: Unveil the Secrets to Powerful Influence

Key Dates to Remember for the Capital One Bank Settlement 2024

Don’t miss the important dates if you want to receive your settlement. Here’s a quick list:

- Claim Deadline: The final date to file your claim.

- Payout Distribution: Estimated date for when payouts begin.

Visit the official settlement website for exact dates, as they can vary.

The Capital One Bank Settlement 2024 is a chance for affected customers to receive compensation. Now that you know the basics, ask yourself, “Capital One Bank Settlement 2024—how much will I get?” If eligible, don’t hesitate to file a claim. This settlement is designed to help those affected; your share is waiting.